Auto Insurance in and around Los Angeles

Auto owners in the Los Angeles area, State Farm can help with your insurance needs.

Put it into drive, wisely

Would you like to create a personalized auto quote?

State Farm Has Coverages For Your Needs

With State Farm, you can drive with confidence knowing your auto policy is dependable and reliable. With a number of savings programs like Multiple Lines and Claim-Free, State Farm aims to give you excellent savings. Not sure which savings options are applicable to you? Gregory Kim can help you double-check your savings options.

Auto owners in the Los Angeles area, State Farm can help with your insurance needs.

Put it into drive, wisely

Your Quest For Auto Insurance Is Over

Even better—dependable coverage from State Farm is possible for a wide array of vehicles, from pickup trucks to SUVs to sedans to smart cars.

But the coverage doesn’t stop there. Did you know State Farm also covers mini-bikes, ATVs, camping trailers and snowmobiles?! With State Farm Agent Gregory Kim, a policy can be personalized for your assortment of vehicles as well as your situational needs to include options like car rental insurance and rideshare insurance.

Have More Questions About Auto Insurance?

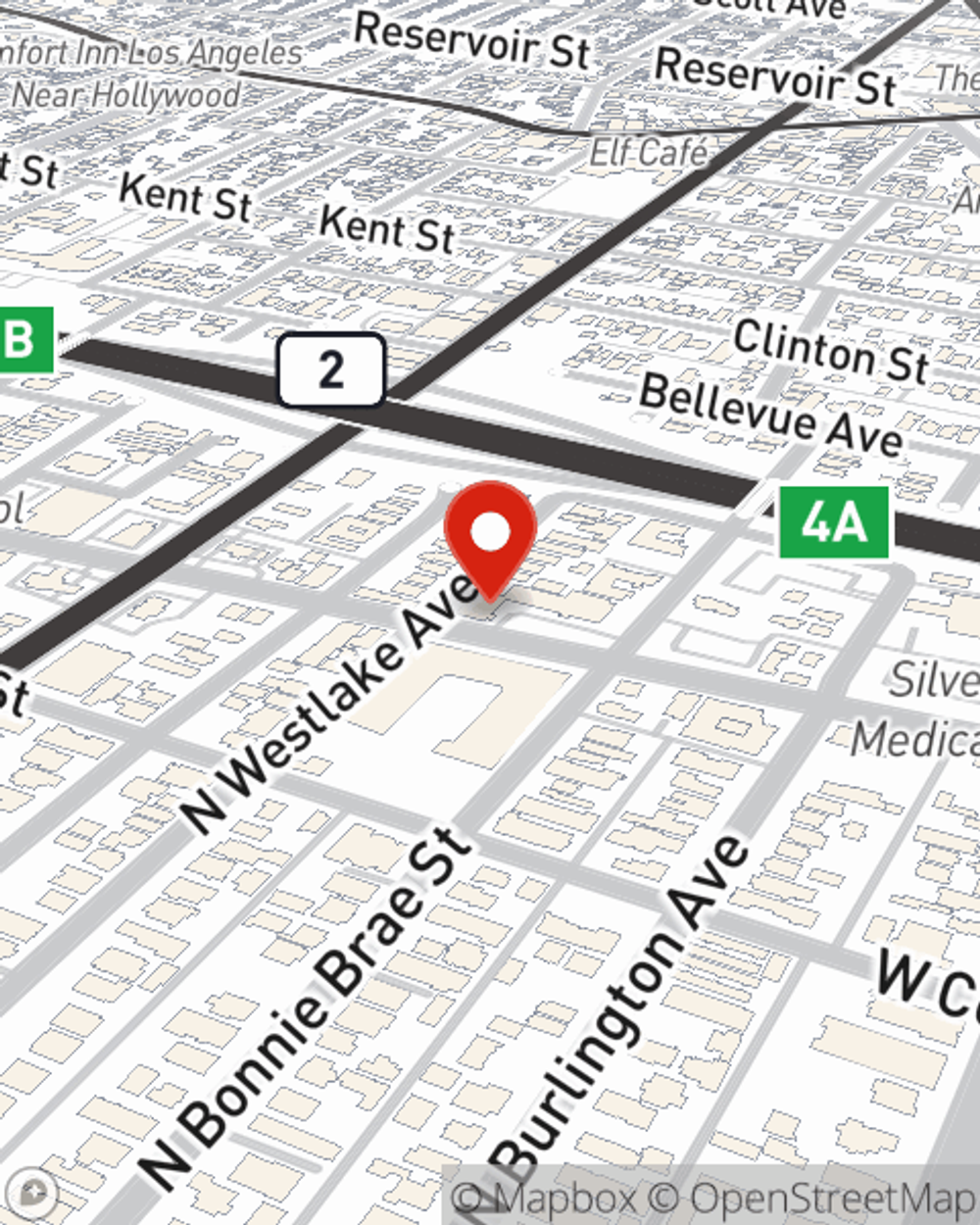

Call Gregory at (213) 388-4955 or visit our FAQ page.

Simple Insights®

5 common rideshare insurance misconceptions debunked

5 common rideshare insurance misconceptions debunked

Learn the truth about common rideshare insurance misconceptions and how to recognize your rideshare insurance options.

What does liability insurance cover?

What does liability insurance cover?

Discover what liability car insurance covers, including bodily injury (BI) and property damage (PD), with examples of covered expenses.

Gregory Kim

State Farm® Insurance AgentSimple Insights®

5 common rideshare insurance misconceptions debunked

5 common rideshare insurance misconceptions debunked

Learn the truth about common rideshare insurance misconceptions and how to recognize your rideshare insurance options.

What does liability insurance cover?

What does liability insurance cover?

Discover what liability car insurance covers, including bodily injury (BI) and property damage (PD), with examples of covered expenses.